- #TRANSUNION FREEZE LIFT PHONE NUMBER HOW TO#

- #TRANSUNION FREEZE LIFT PHONE NUMBER FULL#

- #TRANSUNION FREEZE LIFT PHONE NUMBER FREE#

However, it’s essential to note that a fraud alert does not provide the same level of protection as a credit freeze, as it only requires creditors to take extra precautions rather than denying access to your credit report completely.

#TRANSUNION FREEZE LIFT PHONE NUMBER FREE#

Fraud alerts remain on your credit report for one year and are free to place with any of the major credit reporting agencies. A fraud alert notifies potential creditors that you may be a victim of identity theft, prompting them to take extra steps to verify your identity before granting credit. If you want to keep an eye on your credit without freezing it entirely, you may consider placing a fraud alert. If you no longer wish to maintain a credit freeze on your account, you can permanently remove it in the same manner-online, by phone, or by mail. You’ll need your PIN or account information to lift the freeze, and you can specify the time frame that the freeze should be lifted (e.g., for one week or one month). You can do so online, by phone, or by mail using the contact information provided above. If you need to apply for new credit, you can temporarily lift the credit freeze with TransUnion. You must separately request a credit freeze from each agency. It’s important to remember that placing a credit freeze with TransUnion does not automatically freeze your credit report with the other two credit reporting agencies, Equifax and Experian. If you set up a credit freeze online, you’ll be prompted to create an account to manage the freeze instead of receiving a PIN. Receive a PIN or create an account: If you request a credit freeze by phone or mail, TransUnion will provide you with a unique PIN (personal identification number) that you’ll need to manage your credit freeze.If you’re submitting a request by mail, be sure also to include a copy of a government-issued identification and proof of address.

#TRANSUNION FREEZE LIFT PHONE NUMBER FULL#

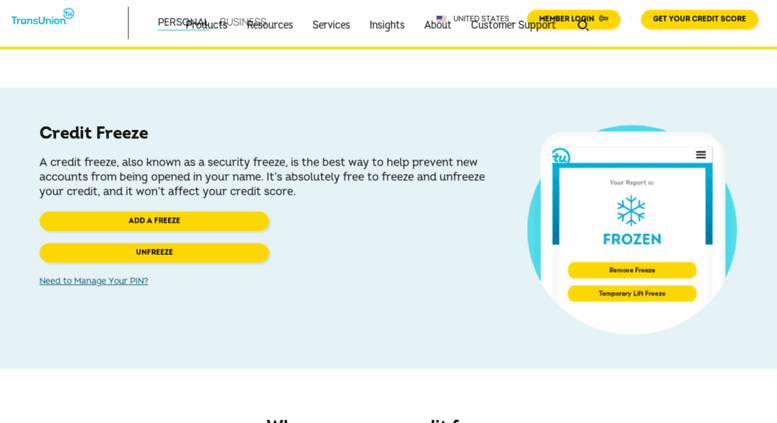

Provide personal information: To verify your identity, you’ll need to provide personal information, such as your Social Security Number, date of birth, full name, and current address.To place a credit freeze online, visit TransUnion’s freeze request page at Alternatively, you can call 1-88 or mail your request to TransUnionLLC, P.O. Contact TransUnion: You can request a credit freeze online, by phone, or by mail.Steps to Place a Credit Freeze with TransUnionįollow these simple steps to place a credit freeze with TransUnion: Free to implement: As per federal law, it’s free to place, lift, or remove a credit freeze with all three credit reporting agencies.No impact on credit score: A credit freeze does not affect your credit score, nor does it prevent you from accessing and reviewing your credit report or applying for new credit with the freeze temporarily lifted.Control over your credit report: A credit freeze gives you control over who can access your credit report, allowing you to decide when and with whom your information is shared.Increased security: A credit freeze minimizes the risk of identity theft, making it difficult for criminals to fraudulently open new accounts or take out loans in your name.

Placing a credit freeze on your credit reports can provide several advantages: Lenders and creditors typically check your credit report before issuing new credit, and a credit freeze blocks them from doing so unless you temporarily lift the freeze. A credit freeze makes it more difficult for criminals to open new credit accounts in your name, as it prevents unauthorized access to your credit report.

#TRANSUNION FREEZE LIFT PHONE NUMBER HOW TO#

This article will walk you through the process of implementing a TransUnion credit freeze, explaining what it is, its benefits, and how to request or lift a freeze. One significant action you can take is placing a credit freeze with TransUnion, one of the three main credit reporting agencies in the United States. Identity theft and financial fraud are constantly on the rise, which is why it’s essential to take steps to protect your personal and financial information.

0 kommentar(er)

0 kommentar(er)